We envision a world where everyone has a decent place to live. We can help you buy a home you love, with a mortgage you can afford.

Habitat Kent provides homebuyers with the coaching, education, and support to be successful in your homebuying journey. Your options may include buying a home built or rehabbed by Habitat Kent.

Martin and Nancy

Occupation: Banking Interpreter

Habitat Kent Homeowners since 2020

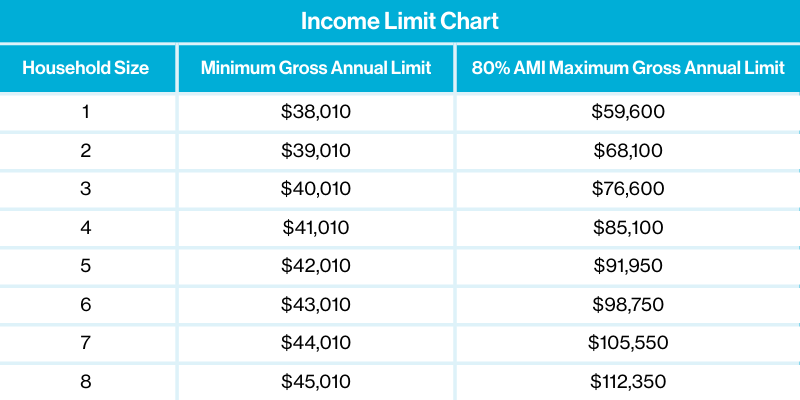

Do you meet the income requirements?

If you meet the household income requirements below, then you may be eligible for the homeownership program. Begin with Phase One below.

How to Apply

Phase One:

* If you do not meet our homeownership program qualifications, you will receive a letter with recommendations for improving your eligibility

Phase Two:

*To get bank approved, you may use any lender you choose. Below are our partnering banks and lenders:

Interested in getting homeownership updates?

Interested in getting homeownership updates? Join our interest list below and get emails about new homeownership opportunities!

Shop for a Lender

For tips on how to shop for a lender, check these resources:

Habitat for Humanity supports equal housing opportunity and does not discriminate on the basis of race, color, religion, sex, national origin, disability, familial status, age, marital status, sexual orientation, gender identity or lawful source of income.

Featured Homes

500 Adams St SE

4 bed

1.5 bath

Sale Pending

Two-story, Single-Family home. 4 bedrooms, 1.5 baths, main floor laundry, 2-stall garage, new counters, new plumbing.

1149 Cass Ave SE

3 bed

1 bath

Sale Pending

One-Story, Single-family home. New build. 3 beds, 1 bath, open floor plan, stainless steel appliances, washer and dryer, off-street parking, large front porch, spacious storage shed

Have a question about homeownership?

If you have questions about our Homeownership Program qualification criteria or process, please reach out to us. We’re happy to help.

Lindsay and Jon

Occupation: U.S. Army Veteran

Habitat Kent Homeowners since 2017

Homeownership FAQ

Habitat homes are not given away. Qualifying families purchase their homes through a bank and pay their mortgage.